Biophilic design is revolutionizing interior spaces by seamlessly merging the beauty of nature with modern…

2025 Trends in the U.S. Service Contractor Market: Growth, Demand, and Opportunities

Introduction: The Shifting Landscape of Service Contracting

The U.S. service contractor market is undergoing significant changes, fueled by growing customer demand and the evolving needs of both residential and commercial clients. As we enter 2025, various industries—from HVAC to landscaping—are seeing a surge in work opportunities and the number of new contractors joining the market. Understanding these shifts is essential for thriving businesses in this dynamic environment.

This blog will break down key trends, highlight growth sectors, and provide actionable insights for service contractors looking to capitalize on these opportunities.

🎧 Listen to the Episode

🌟 Dive into our latest podcast episode where we uncover:

- ✨ Title: 2025 Trends in the US Service Industry

- ✨ Topics: Upcoming trends, strategies for adaptation in 2025

- ✨ Why Listen: Learn how businesses can adapt to emerging trends!

🎙️ Tune in below or on your favorite podcast platform! 🎙️

🎙️ Powered by iHeart Podcasts 📻

Overview of the U.S. Service Contractor Market

In 2024, the service contractor industry expanded significantly, driven by a growing population, increasing homeownership, and the rise of smart home technologies. The home services sector alone was estimated to be worth over $600 billion, with an annual growth rate of around 4.5%—a trend expected to accelerate into 2025.

Service contractors increasingly rely on platforms like SendWork to manage the growing demand, streamline administrative tasks, and automate communication and scheduling.

At SendWork, we support contractors across various industries. Some of the key sectors we cover include:

HVAC (Heating, Ventilation, and Air Conditioning)

Manage your HVAC business with ease. From scheduling maintenance to invoicing clients, SendWork offers tools that streamline HVAC operations.

- 2025 HVAC Industry Trends →

- Explore HVAC Solutions →

- Building Skills for a Sustainable, High-Tech Future →

- Regional HVAC Market Insights: Key Growth Areas →

Plumbing

Simplify plumbing job management with SendWork’s powerful tools for scheduling, invoicing, and task tracking.

- 2025 Plumbing Industry Trends →

- Discover Plumbing Solutions →

- Regional Plumbing Market Insights →

- The Future of Plumbing Workforce: Attracting Young Talent and Diversifying the Industry →

Electrical Services

For electricians, SendWork offers features that simplify task management, invoicing, and customer communication.

Landscape and Gardening

SendWork helps contractors in landscaping and gardening manage projects efficiently with robust scheduling and invoicing tools.

- 2025 Landscaping and Gardening Trends →

- Explore Landscaping Solutions →

- Landscape Design: Wellness-Focused Trends Shaping the Future →

Painters and Decorators

SendWork facilitates the management of projects for painters and decorators through powerful scheduling, invoicing, and task management tools.

- 2025 Painting and Decorating Trends →

- Explore Painting and Decorating Solutions →

- Smart Paint and Tech Decorating →

Cleaning Services

Cleaning businesses can optimize their operations with SendWork’s scheduling, invoicing, and customer tracking tools.

- 2025 Cleaning Industry Trends →

- Explore Cleaning Services →

- Cleaning Industry Technology: Smart Tools & Trends→

Locksmiths

Locksmith businesses can enhance their operations by utilizing SendWork’s scheduling, invoicing, and customer tracking tools.

- 2025 Locksmith Trends →

- Commercial Locksmithing Access Control: Integrating Physical and Digital Security →

Pest Control

Pest control businesses can enhance their operations by utilizing SendWork’s comprehensive suite of tools, which include scheduling, invoicing, and customer tracking features.

Sector-Specific Growth Trends and Volumes

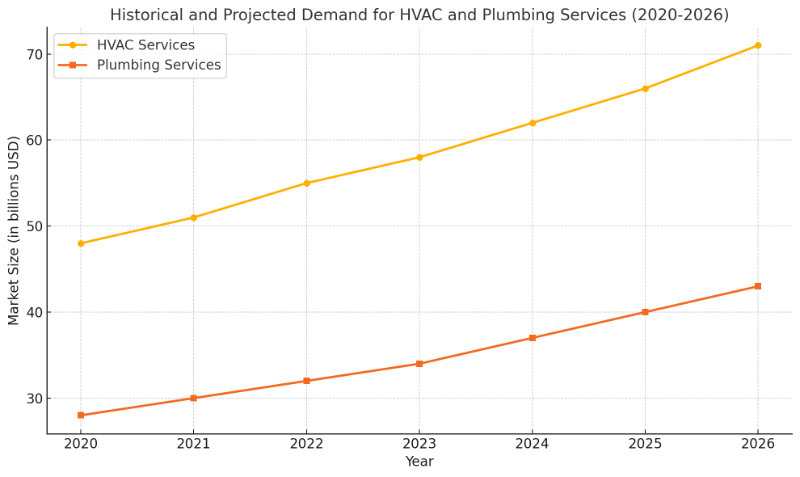

HVAC and Plumbing – Essential Services Driving Demand

The HVAC and plumbing sectors continue to see consistent growth due to the essential nature of their services. According to market data, the HVAC market in the U.S. is projected to grow by 6.1% annually from 2023 to 2028. Similarly, the plumbing sector is expected to grow by 5%, with increasing demand from new residential construction and aging infrastructure in older homes.

Customer Demand Chart – HVAC and Plumbing Services:

The following chart illustrates the increasing demand for HVAC and plumbing services over the next several years. As more homes are built and older systems require maintenance or upgrades, the need for skilled contractors in these fields will continue to grow.

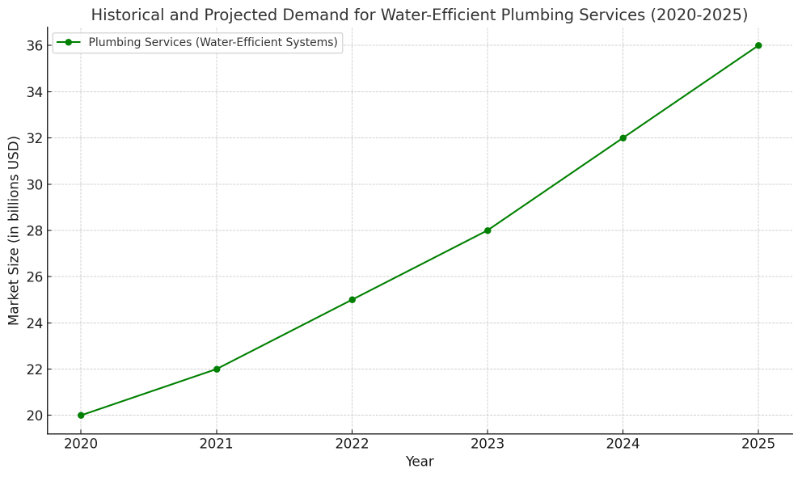

Plumbing Upgrades Supporting Water Conservation

As environmental awareness grows and local governments implement stricter water conservation regulations, more homeowners are investing in plumbing upgrades that help conserve water. These upgrades often include the installation of water-efficient fixtures, improved irrigation systems, and smart leak-detection technologies. These plumbing solutions align with ecological goals and consumer demand for sustainable home improvements by reducing water usage and preventing waste.

Sector-Specific Growth Trend – Plumbing Upgrades:

This trend reflects the evolving nature of customer demand in the plumbing sector, particularly in regions facing water scarcity and tighter conservation laws. Contractors specializing in water-efficient systems are seeing a steady rise in requests for these services.

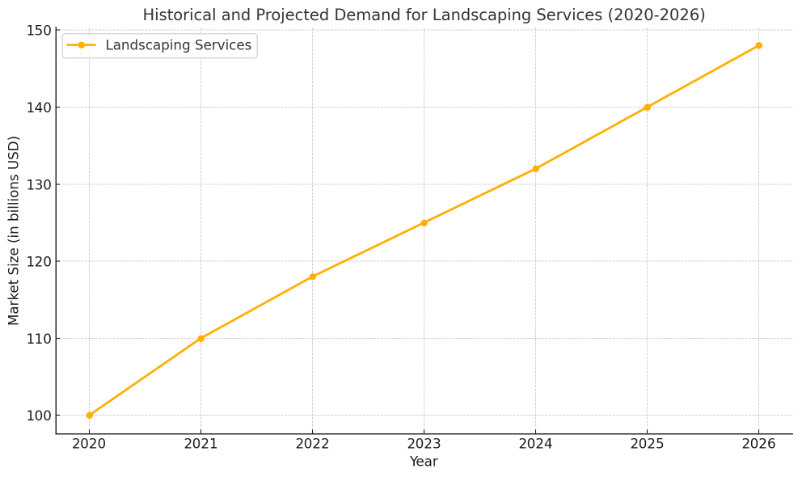

Landscaping – Seasonal Growth and High Demand in Residential Areas

Landscaping services, particularly in residential markets, have seen significant growth. The U.S. landscaping services market is valued at over $129 billion, with a notable rise in customer demand in suburban and rural areas where outdoor space is prioritized. The surge in demand for sustainable and eco-friendly landscaping has also expanded the sector.

Customer Demand Chart – Landscaping Services:

The following chart shows the steady rise in demand for landscaping services, highlighting seasonal peaks and the growing preference for sustainable, environmentally conscious landscaping.

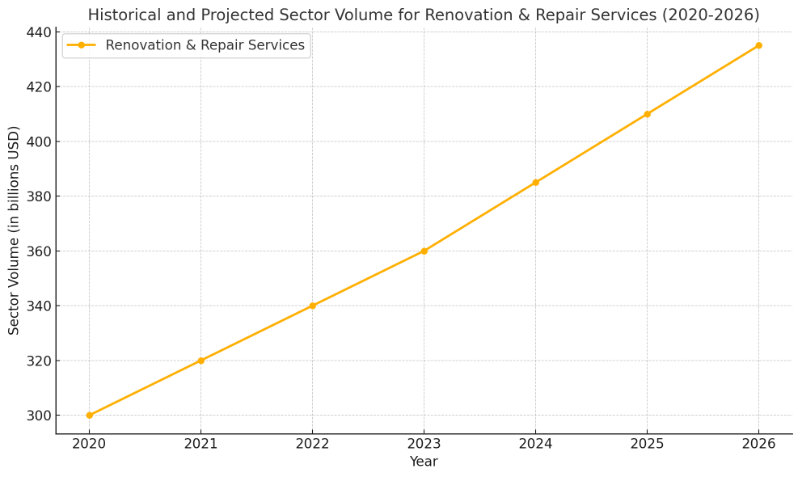

Home Renovations and Repairs – Aging Housing Stock Driving Growth

As the U.S. housing stock ages, home renovations and repair services have become one of the fastest-growing sectors in the service contractor market. The home remodeling market is projected to grow by 3.5% annually through 2025. Rising home values and increased consumer spending on renovations have propelled this market forward.

Sector Volume Chart – Renovation & Repair Services:

The following chart illustrates the growing volume of renovation and repair services in the U.S. As homes age and more homeowners invest in remodeling projects, the demand for contractors in this sector is expected to rise steadily over the coming years.

New Workforce Trends in Service Contracting

Growing Number of Young Workers Entering the Market

In recent years, there has been a notable shift in the demographics of new workers entering the service contractor market. Many younger workers seek alternatives to traditional four-year college degrees, turning to trade schools and vocational training. According to recent surveys, over 50% of high school graduates are considering trade careers, with HVAC, plumbing, and electrical services leading the way.

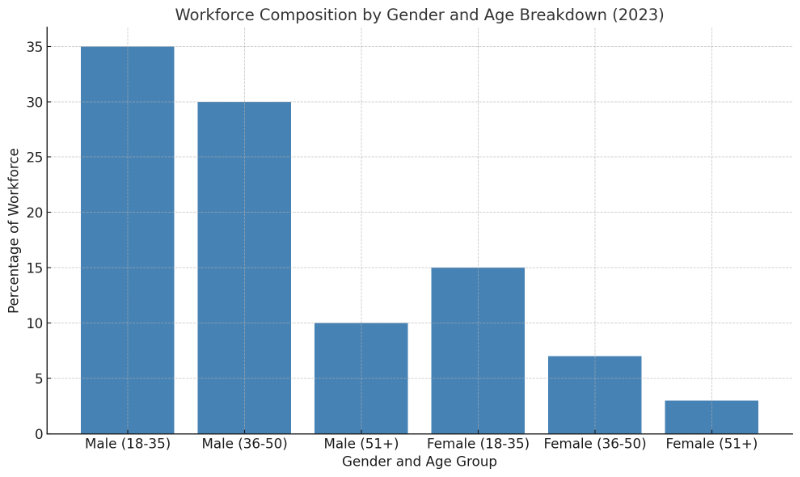

Growth of Women in Contracting

Another emerging trend is the increasing number of women entering the service contracting workforce. Historically, male-dominated industries like plumbing and electrical services have seen a rise in female contractors. Women now make up approximately 9% of the construction and service contractor workforce, which is expected to grow in 2025 and beyond.

Workforce Composition Chart – Gender and Age Breakdown:

The following chart breaks down the composition of the service contractor workforce by gender and age. It highlights the growing participation of younger workers and women in the field, signaling a diversification of the contractor labor force as we move into 2025 and beyond.

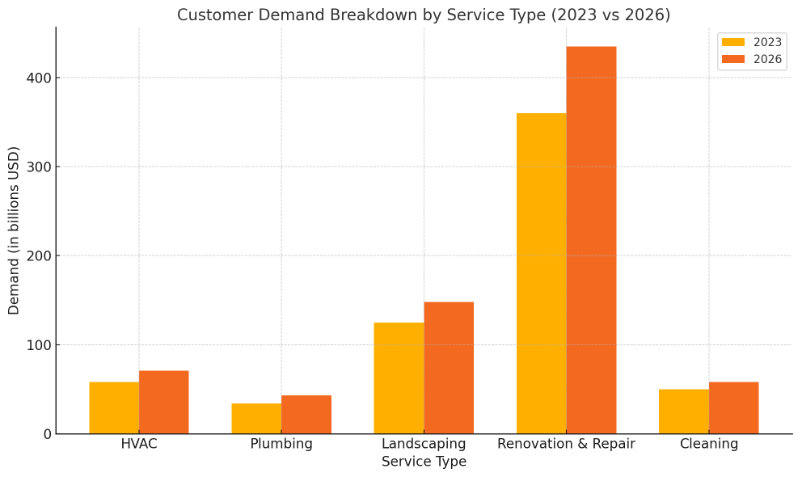

Customer Demand Insights for 2025

Demand for service contractors is rising, driven by several factors, including a booming real estate market, increased home renovations, and heightened interest in energy efficiency. SendWork contractors have seen an uptick in customer requests for:

- Smart home installation services: As smart home technology becomes more popular, homeowners increasingly seek contractors to install smart thermostats, lighting systems, and security cameras.

- Energy-efficient HVAC systems and solar panel installations: With rising energy costs and environmental concerns, customers are turning to contractors for energy-efficient upgrades, including replacements and installations. According to data from the U.S. Energy Information Administration, demand for renewable energy and energy-efficient technologies continues to proliferate across the country.

- Home repairs following natural disasters: Particularly in hurricane-prone areas like Florida and Texas, contractors are receiving more requests for emergency home repairs to restore properties affected by severe weather.

- Plumbing upgrades to support water conservation: More homeowners are investing in plumbing upgrades that conserve water, driven by environmental awareness and local water usage regulations.

Customer Demand Chart – Service Breakdown by Type:

The following chart breaks down customer demand by service type, illustrating which sectors are seeing the most significant growth. From energy-efficient HVAC installations to home renovations and plumbing upgrades, this chart highlights the trends shaping the U.S. service contractor market in 2025.

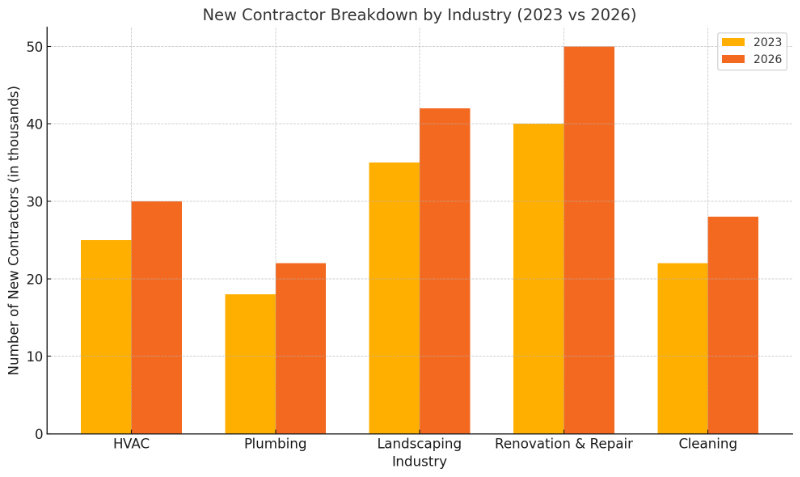

Top Industries for New Contractors in 2025

Several industries are seeing a significant influx of new workers, mainly due to rising demand and relatively low barriers to entry. As demand increases, these industries offer substantial opportunities for new contractors entering the market.

Electrical Services – High Demand for Skilled Labor

The electrical services industry is experiencing a surge in demand due to the growing trend of smart home technologies and renewable energy installations like solar panels. New contractors are increasingly entering this field due to the work’s lucrative opportunities and future-proof nature.

Cleaning and Maintenance Services – A Popular Entry Point

Cleaning services, including both residential and commercial maintenance, have seen a consistent rise in new entrants. With minimal startup costs and flexible hours, many individuals are turning to this industry as a first step into the contractor market.

New Contractors Entering the Market – Breakdown by Industry

As demand for services grows, many industries are attracting new contractors. From electrical services to cleaning and maintenance, these sectors offer lucrative opportunities for individuals looking to enter the contractor workforce. The influx of new contractors is reshaping the industry, providing fresh talent and helping meet the rising demand for skilled labor.

New Contractor Chart – Breakdown by Industry:

The following chart provides a detailed breakdown of new contractors entering different industries, showcasing where the highest influx of new workers is occurring. It highlights sectors such as electrical, HVAC, plumbing, and cleaning services, which are experiencing significant workforce growth due to increased customer demand.

Conclusion – A Promising Future for U.S. Service Contractors

As we head into 2025, the U.S. service contractor market is poised for further growth. With rising customer demand, a growing workforce, and expanding sectors, 2025 presents ample opportunities for contractors to thrive. Platforms like SendWork are increasingly essential in helping contractors manage the complexities of a growing market, automate administrative tasks, and ultimately focus on delivering high-quality services.

Join Now and See How SendWork Can Grow Your Business

Try SendWork for Free